Alector (ALEC) was founded in 2013 and is based in South San Francisco, Calif.

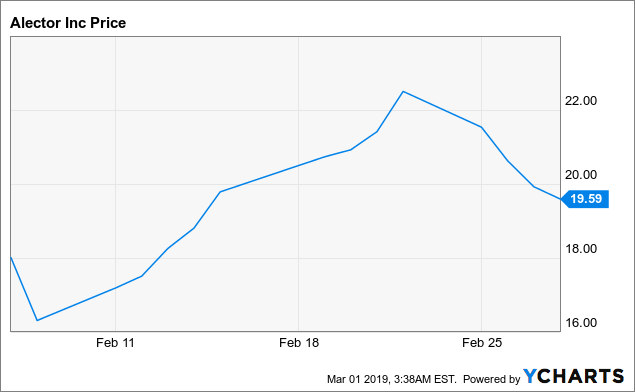

Data by YCharts

Data by YCharts

(Alector, common stock price chart)

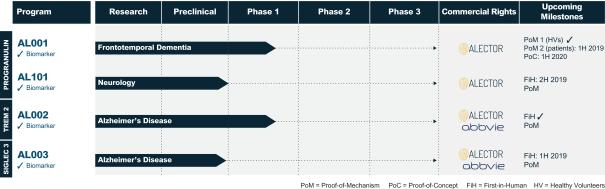

IPO price= $19/share. 52-week price range= $15.55 - $22.50 Market cap= $1.35 billion Net amount raised from IPO: $163.4M. Cash reserves after IPO (excluding Q4 burn)= $468.5M, enough for 12 months per the management. Outstanding diluted share count after the IPO= 68.3M Targeting genetic mutations in neurodegenerative diseases that increase neuro-inflammationThe company has identified over 40 immune system targets, tested over 10 programs in preclinical studies and advanced 2 programs into clinical studies so far.

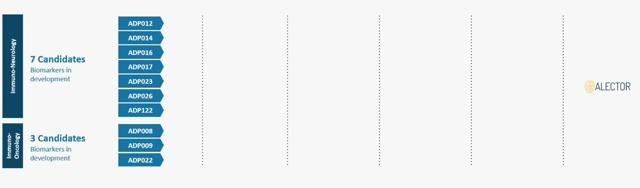

(Identified programs in the R&D pipeline)

The identified programs in the above figure include:

Seven neurology programs including those targeting Alzheimer's disease, Parkinson's disease, amyotrophic lateral sclerosis (ALS), and progressive multiple sclerosis. Three oncology programs focused on targeting innate immune cells.At present, the management is working on identifying the biomarkers to be utilized in preclinical studies for these programs which are expected to be conducted in the next 1-3 years.

Addressing neuro-inflammation in neurodegenerative diseasesNeuroinflammation in Alzheimer's disease: a double-edged sword:

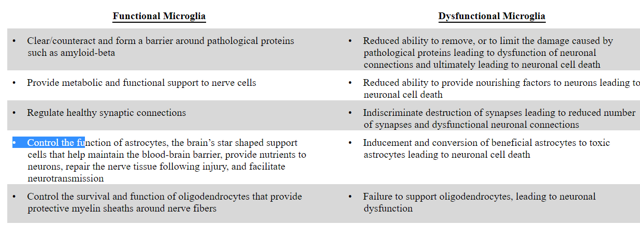

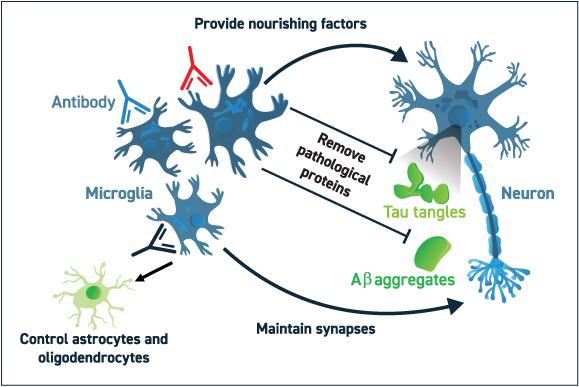

Microglial cells form the innate immune cell system of the brain. These cells perform various functions like responding to infection and damage, clearing cell debris and pathological proteins, nurture neurons and brain support cells and control the number and functionality of inter-neuronal connections. Microglia also control the survival and function of astrocytes and oligodendrocytes in the brain and modulate the permeability of the blood-brain barrier, thus allowing peripheral immune cells to the brain to assist in protecting against infections and injury. Gliosis and neuroinflammation in AD can be either beneficial or harmful, e.g. reactive microglia and astrocytes can contribute to clearance of amyloid-beta. Conversely, production of proinflammatory cytokines like TNF-alpha or IL-1-beta resulting from excessive glial activation can be harmful and toxic to neurons. Neuroinflammation also exacerbates tau protein phosphorylation and causes a decrease in neurogenesis (neurogenesis is necessary to maintain certain cognitive functions in AD).

The 'double edge sword' concept of brain microglia is summarized in the table given below.

(Alector's approach to correcting the dysfunctional microglia)

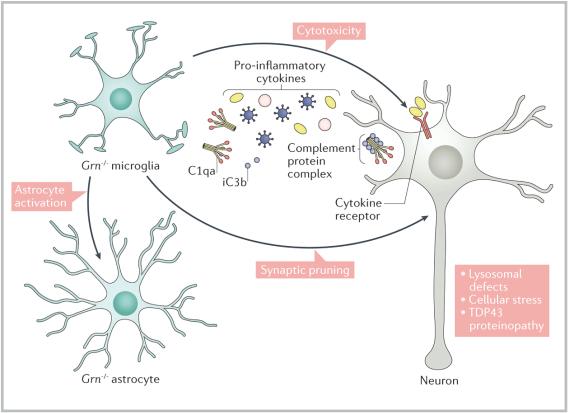

Role of progranulin in neurodegenerative diseases and Alector's approachProgranulin, PRGN is a growth factor that plays a role in development, wound repair, neuroinflammation, autophagy and lysosomal function. The gene that codes for progranulin, GRN is on chromosome 17. Normal people carry two copies of PGRN. PGRN deficiency due to mutations in GRN gene disrupt microglia-neuronal homeostasis in the brain and promote neurodegeneration through the release of cytotoxic cytokines and complement factors by dysfunctional microglia.

(Mechanism of promotion of neurodegeneration by PGRN deficiency)

Mutations in both copies of PGRN gene cause a neurodegenerative disease called neuronal ceroid lipofuscinosis. Mutations in one copy of PGRN cause a 50%-70% decrease in PGRN and a 90% probability of developing frontotemporal dementia. As many as 70 different mutations in GRN gene have been reported. In addition to FTD, certain mutations in PGRN which may lead to just a moderate decrease in PGRN may increase the risk for Alzheimer's disease and Parkinson's disease as well.

Targeting progranulin loss of function mutation in frontotemporal dementia

The size of the problem:

Frontotemporal dementia, FTD is a neurological disorder characterized by disturbances in behavior, personality, and language and focal degeneration of the frontal and/or temporal lobes. The disorder includes a spectrum of neurological diseases that can also be classified based on the characteristic cytoplasmic or nuclear protein inclusions. There is a behavioral variant (seen in 60% cases and characterized by indifference, impatience, carelessness, jocularity, insensitivity, distractibility, impulsiveness, stereotyped behaviors, compulsions, and rigid routines) and a language variant (effortful, dysfluent, agrammatical speech, and impaired comprehension of sentences, or fluent, vacuous speech, with anomia and word and object agnosia). The behavioral variant may be confused with psychiatric disorders like schizophrenia, bipolar depression or major depressive disorder. Atypical presentations include speech and limb apraxia, parkinsonism or motor neuron disease. There may also be an overlap between FTD and other neurodegenerative disorders like motor neuron disease. FTD is one of the causes of early-onset dementia (along with Alzheimer's disease) with a mean age of onset of 58 years. The life expectancy in FTD is very reduced to 3-14 year after the diagnosis, with the death occurring due to pneumonia, cardiopulmonary failure, failure to thrive, etc.

The estimated point prevalence is 15-22/100,000, and incidence is 2.7-4.1/100,000. FTD affects approximately 50,000 to 60,000 individuals in the United States and roughly 110,000 individuals in the European Union (prospectus). The prevalence is believed to be higher in Asia and Latin America.

A hereditary basis may be seen in up to 40% cases of FTD where approx. 10%-25% have autosomal dominant inheritance. The prevalence of the top 3 genetic mutations causing familial FTD is given below:

C9ORF72 gene: most common genetic mutation in FTD= 10%-25% of all FTD: tau-negative, TDP-43 protein aggregates seen. GRN gene: approx. 5%-10% of all FTD: characterized by behavioral changes though language abnormalities may also be seen, tau-negative. TDP-43 protein aggregates seen. MAPT gene: approx. 3% of all FTD, tau-positive (aggregates of tau protein seen).There are currently no FDA approved disease-modifying treatments for FTD. There are no approved medications which have shown an improvement in the cognitive dysfunction in the disease. Antidepressants like SSRIs or antipsychotic drugs are sometimes used to treat the behavioral symptoms though they may paradoxically worsen the symptoms.

The solution:

Blocking SORT1 receptor using humanized monoclonal antibodies to upregulate PGRN levels in the brain

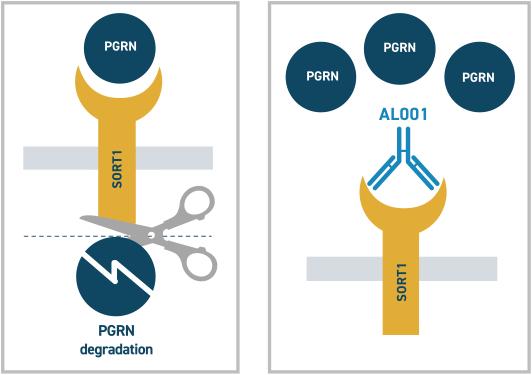

SORT1 is a major negative regulator of PGRN levels in the brain and the plasma. It binds to extracellular PGRN in the plasma and brain and transports it inside cells for lysosomal degradation.

AL001 and AL101: antibodies that block the SORT1 receptor in the brain

AL001 is a humanized monoclonal antibody which is targeting patients with FTD with GRN mutation. It is given through a peripheral intravenous route. It acts by blocking SORT1 receptors in the brain and preventing PGRN degradation, thus increasing the half-life of PGRN significantly.

(Mechanism of action of AL001)

Preclinical data for AL001:

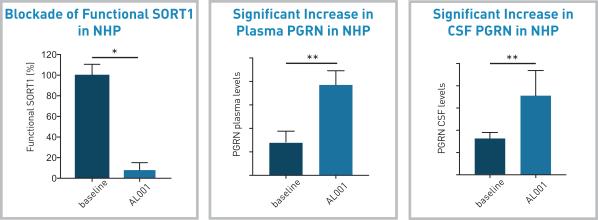

In preclinical studies in non-human primates, significant blockade of SORT1 receptors and increase in CSF and plasma PGRN levels were seen after administering AL001 (see the figure below).

Similar impressive results were shown by using

Clinical studies for AL001

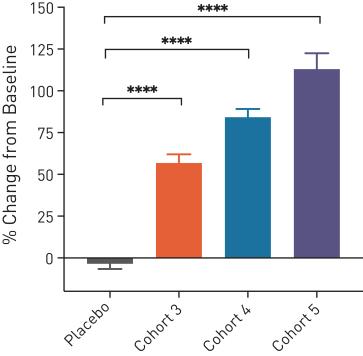

A phase 1 single ascending dose study has enrolled 44 healthy volunteers so far. The treatment was safe and well-tolerated. The proof-of-concept was shown by a significant increase in plasma and CSF PGRN levels compared to the baseline (see the figure below), **** indicated p-value below 0.0001.

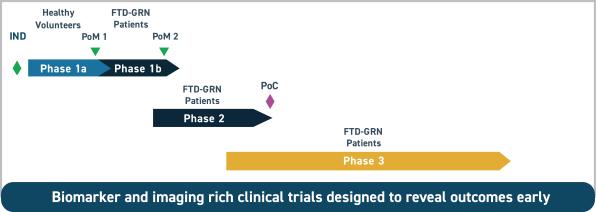

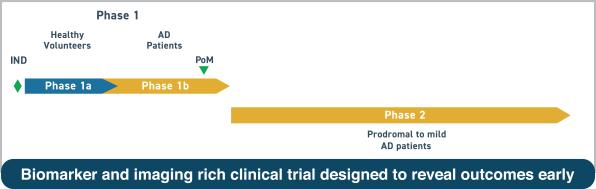

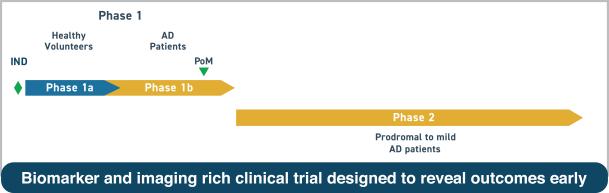

Development timeline:

A phase 1b study testing AL001 in FTD-GRN patients is expected to start in the first half of 2019. A phase 2 study is expected to start in the first half of 2020 where multiple CSF biomarkers, brain imaging, and multiple cognitive and behavioral tests are expected to be used.

(Clinical plan for AL001 in FTD-GRN)

AL001 has received Orphan Drug designation from FDA for the treatment of FTD.

Testing AL001 in FTD with C9orf72 mutations, another large market

The management also plans to test AL001 in FTD with C9orf72 mutations in the phase 1b trial this year (target market= approx. 15,000 patients in the U.S.+E.U. per prospectus). As mentioned above, this is the most common genetic mutation seen in familial forms of FTD. By targeting these two most common genetic mutations in FTD, AL001 will be targeting approx. 35% of all FTD (approx. one-third of all FTD cases and 88% of all familial cases of FTD). The management is also leaving the door open to include additional subsets of FTD.

Muscle injury in AL001 phase 1 study: In the phase 1 study, one subject developed a severe form of rhabdomyolysis, a muscle injury 8 weeks after a single dose of AL001, which was attributed to strenuous activity and not considered to be related to the study drug as per the study investigator. This case of rhabdomyolysis did not need any specific treatment and resolved itself after rest. Another case of muscle injury 8 weeks after dosing AL001 was also reported by another study investigator but was not considered to be drug-related.

I am not concerned about these reported events due to two reasons: They have been considered not to be drug-related by the study investigators (who have an obligation to report the adverse events correctly). Considering that there are no treatment options for FTD and limited survival after diagnosis, such minor adverse events (which may resolve with just a lot of oral fluids and rest), even if they are somehow drug-related, are acceptable.

Development of biomarkers: Since the clinical presentation of FTD does not correlate with the type of mutation, the company is also developing specific biomarkers for the above two genetic mutations, including molecular biomarkers, assays, and imaging techniques.

Patents for PGRN program are expected to extend till 2039.

Voyager Therapeutics (VYGR) is planning a gene therapy program targeting tau-protein in FTD but it is not a competition for the two mutations being targeted by Alector since they are tau-negative.

AL-101: A treatment addressing PGRN deficiency in both Alzheimer's disease and Parkinson's disease

The scope of the problem:

Alzheimer's disease:

The most common cause of dementia, accounting for 60% to 70% of all cases. There are 5.7 million people in the United States suffering from Alzheimer's disease.The prevalence is projected to rise to nearly 14 million by 2050.

Alzheimer's disease is the sixth leading cause of death in the United States. Alzheimer's disease drug market is expected to reach $13 billion in size by 2023. Aricept reached a peak of $2.4 billion sales in 2010. Namenda reached a peak of $2.3 billion sales in 2013.Parkinson's disease:

More than 10 million people worldwide are living with Parkinson's disease, PD. An estimated 930,000 people in the United States will be living with Parkinson's disease by the year 2020. This number is predicted to rise to 1.2 million by 2030. Parkinsonism is more common in FTD and AD patients with PGRN mutation. Progranulin gene delivery was shown to be neuroprotective to dopaminergic neurons in a mouse model of PD.AL101:

AL101 also acts by blocking SORT1 receptors, thus increasing PGRN levels in the brain and plasma. As mentioned above, certain mutations in GRN gene which may produce a moderate reduction in PGRN levels may cause Alzheimer's disease and Parkinson's disease. The therapy may be useful in a subset of AD patients who are deficient in brain PGRN (CSF PGRN levels can thus be used as a biomarker).

This paper suggests that PGRN levels correlate with TREM2 levels (see below) in those AD patients which develop neurodegenerative symptoms like dementia. Thus, PGRN levels by itself may not be a very useful diagnostic marker but when combined with TREM2 levels, the two together are good biomarkers of microglial activity in AD patients. Knocking out TREM2 in microglia has the opposite effect of knocking out PGRN. Without TREM2, microglia got stuck in a resting state; without PGRN, they became hyperactive.

Successful development in these two common neurodegenerative diseases could add significant future revenue. The scientific basis for targeting PGRN in these 2 diseases is clear from the explanation above.

Targeting TREM2 mutations in Alzheimer's diseaseTREM2 mutation and Alzheimer's disease:

TREM2 (triggering receptor expressed on myeloid cells 2) mutation exacerbates dysfunction in molecular receptor medicated pathways related to inflammation, which downregulates good cellular responses and provokes dysregulation of immune responses in the brain. TREM2 is an example of genetic factors which increase the role of developing AD, thus confirming the role of microglia in AD pathogenesis.

TREM2 mutations have been shown to increase the risk of developing AD by 3-5x in patients with European or North American descent but not in African-American, Chinese or Japanese populations. The prevalence of TREM2 mutations was approx. 2% in over 1000 AD patients in this study. AD subset of patients with this mutation has more apraxia, psychiatric features and Parkinson's disease-like features. They also have an earlier onset of dementia and a faster rate of brain volume loss. Promising biomarkers may be elevated CSF levels of TREM2 or tau protein. TREM2 binds to membrane lipids and lipoproteins such as Apolipoprotein E (ApoE) which are normally found in the brain. Mutations in the gene for ApoE are also known to significantly increase the risk of development of Alzheimer's disease and is the single highest risk factor for Alzheimer's disease.Alector's solution:

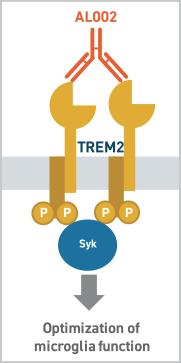

AL002: It is a humanized, monoclonal antibody which binds to TREM2 (acts as an activator) is designed to optimize microglial activity through the phosphorylation of Spleen Associated Tyrosine Kinase. It is administered through peripheral, intravenous route. It is being developed in collaboration with AbbVie (ABBV). By activating TREM2, AL002 is believed to address multiple pathways involved in the development of Alzheimer's disease, thus increasing the probability of success.

Mechanism of action of AL002.

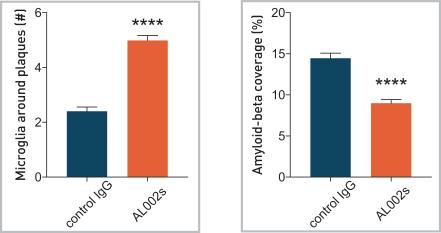

Preclinical studies for AL002:

In a mouse model of AD, AL002 significantly increased the number of microglia around amyloid-beta plaques and reduced the amyloid-beta plaques (**** indicated p-value below 0.0001, please see the figure below).

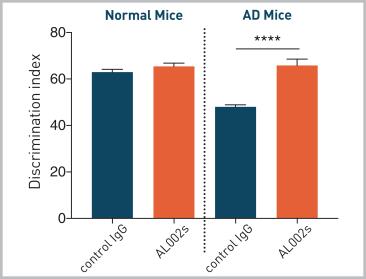

In addition, AL002 also significantly increased cognition in this mouse model of AD ( (**** indicated p-value below 0.0001, please see the figure below).

Clinical plan for AL002 in Alzheimer's disease

AL002 is currently being tested in a randomized, double-blind, placebo-controlled, dose-escalating Phase 1 study in Australia (testing safety/tolerability and pharmacokinetic measurements in serum and CSF). The study will also test various CSF biomarkers. The target enrollment is 48 healthy volunteers and 12 AD patients dosed with 4 doses of AL002 or placebo. The treatment has been found to be safe and well-tolerated so far.

Following the phase 1 study, a double-blind, placebo-controlled proof-of-concept trial in early-stage AD is planned.

Patents for TREM2 program are expected to last till 2038.

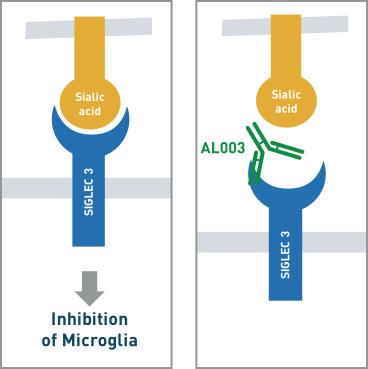

SIGLEC3 in Alzheimer's disease:SIGLEC 3 acts as an inhibitory receptor for microglia in the brain. However, excessive inhibition of SIGLEC 3(due to certain mutations) reduces the functionality of myeloid cells and increases the amyloid-beta plaque deposition in the brain.

AL003:

It is a monoclonal antibody that blocks SIGLEC-3 and is administered through a peripheral intravenous route. By blocking SIGLEC3, it activates microglia (the prospectus compares it to anti-PD1 checkpoint inhibitors in cancer).

(Mechanism of action of AL003)

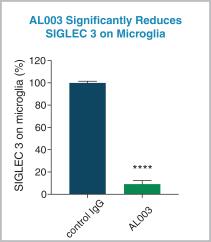

Preclinical data for AL003

In a mouse model, AL003 significantly blocked SIGLEC3 on microglia in the brain ( **** indicates a p-value below 0.0001, see the figure below).

Clinical plan for AL003 in Alzheimer's disease

A phase 1 study testing the safety and tolerability of AL003 in AD patients is planned to start in the first half of 2019.

If phase 2 study shows safety, a double-blind, placebo-controlled, proof-of-concept trial in AD patients is planned which will use molecular and genetic biomarkers as well as novel imaging techniques.

Patents for SIGLEC 3 program are expected to extend till 2039.

Possible expansion into amyotrophic lateral sclerosis, ALS

TREM2 R47H variant has also been associated with an increased risk of ALS. This clinical indication is though not in the pipeline yet but it is always possible to expand it in ALS in the future.

Blue-sky scenarioExpansion into immuno-oncology

The management also plans to target additional innate immune check-point focused programs including programs targeting the SIGLEC protein family and the SIRP protein family in cancer. This approach can be combined with other existing immune-oncology drugs.

PartnershipsAbbVie has licensed the commercial rights for AL002 and AL003. Under this deal, Alector and AbbVie will share the development costs and split the global profits after approval. However, AbbVie also as an option under which it will pay for the development costs and pay tiered royalties to Alector. In addition, Alector is eligible to receive up to $985.6 million in milestone payments.

AL001 and AL101 were licensed from Adimab, so Alector will pay milestone payments and low to mid-single digit royalty payments.

Manufacturing partnerships: Lonza Biologics for the manufacturing of AL001 and AL002, Celonic AG for the manufacturing of AL003, and EMD Millipore Corporation for the manufacturing of AL101.

Experienced management team with the proven track recordThe CEO and co-founder Arnon Rosenthal Ph.D. has 35 years of biotech industry experience. He worked for 16 years at Genentech where he built a team that discovered multiple neuronal survival factors and receptors to prevent neurodegeneration. He also co-founded and served as CEO of Annexon Biosciences. He holds over 350 patents and has over 100 peer-reviewed publications. He has led the development of several successful drugs like AJOVY (for migraine) and tanezumab (for pain).

Chief Medical Officer, Robert Paul, M.D., Ph.D., served as the Therapeutic Area Lead for Neuroscience at Genentech and oversaw the development of amyloid-beta antibody crenezumab in Alzheimer's disease, GDC-0134 in ALS, and GDC-0276 and GDC-0310 in pain.

Chief Development Officer, Robert King, Ph.D., previously served as the Senior Vice President of development and supply chain at SciClone Pharmaceuticals. Chief Business Officer, Sabah Oney, Ph.D., previously served as the Head of Global Sales and Business Development at Ariosa Diagnostics (acquired by Roche).

Strong institutional backingKey investors include major biopharmaceutical companies , like AbbVie, Amgen, and Merck. Prominent institutional investors at an early stage include Orbimed Advisors, Perceptive Advisors, Deerfield Management, Polaris Partners, Lilly Asia Ventures, Casdin Capital, etc

Summary of R&D pipeline

The management expects 4 product candidates to be in clinical trials by the end of 2019.

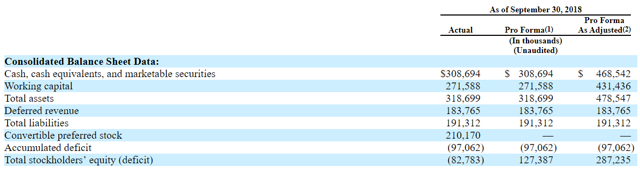

Financials and valuationBalance sheet

Cash reserves after IPO are expected as $468.5M, enough for 12 months per the management. Net operating cash use was $145M for the first 9 months of 2018. I don't expect any immediate need to raise additional capital for next 12 months. There is no long-term debt.

(Alector balance sheet)

(Alector balance sheet)

Use of IPO proceeds

Approx. $50M to fund Phase 1 trials for AL001 and AL002, as well as prepare for Phase 2 and 3 clinical trials for AL001. Approx. $25M to advance AL003 and AL101 in and through Phase 1 clinical trials. Approx. $40M to fund Phase 2 enabling activities for AL002 and AL003. Approx. $25.0 million to continue to advance the preclinical development pipeline into Phase 1 clinical trials. Approx. $15M to further develop the Discovery Platform. The remaining funds to fund working capital and other general corporate activities.Estimating the size of target addressable markets

1. AL001 in FTD with GRN mutations

U.S. Market

Target market= approx. 5000 patients (and 10-20% new cases per year). Annual price estimate= $60,000 (similar to orphan drugs e.g. OCA in PBC). Annual revenue opportunity at the peak = $1.08 billion.European market

Target market= approx. 10,000 patients (and 10-20% new cases per year). Annual price estimate= $30,000 (at 50% U.S. price, average per Pharmagellan guide). Annual revenue opportunity at the peak= $1.06 billion.2. AL001 in FTD with C9orf72 mutations

U.S. Market

Target market= approx. 5000 patients (and 10-20% new cases per year). Annual price estimate= $60,000. Annual revenue opportunity at the peak= $1.06 billion.European market

Target market= approx. 10,000 patients (and 10-20% new cases per year). Annual price estimate= $30,000 (at 50% U.S. price, average per Pharmagellan guide). Annual revenue opportunity at the peak= $1.06 billion.3. AL002 in AD with TREM2 mutations

U.S. Market

Prevalence of AD in the U.S.= 5.7M (expected to rise to $14M by 2050, approx. 3% annual growth). Estimated target market for AD with TREM2 mutations (at 2% prevalence)= 114,000 patients (and 3% annual growth). Annual price estimate= $60,000. Annual revenue opportunity at the peak = $11 billion ($2.2 billion peak royalty revenue opportunity for Alector).European market

Prevalence of AD in the E.U.= 7M (3% annual growth). Estimated target market for AD with TREM2 mutations (at 2% prevalence)= 140,000 patients and 3% annual growth. Annual price estimate= $30,000. Annual revenue opportunity at the peak = $6.6 billion ($1.3 billion peak royalty revenue opportunity for Alector).4. AL003 in AD with SIGLEC mutations

U.S. Market

Prevalence of AD= 5.7M (3% annual growth). Estimated target market at 1% prevalence= 57,000 patients, 3% annual growth. Annual price estimate= $60,000. Annual revenue opportunity at the peak = $5.5 billion ($1.1 billion peak royalty revenue opportunity for Alector).E.U. Market

Prevalence of AD= 7M, 3% annual growth. Estimated target market at 1% prevalence= 70,000 patients, 3% annual growth. Annual price estimate= $30,000. Annual revenue opportunity at the peak = $3.3 billion ($440 million peak royalty revenue opportunity for Alector).Estimating the risk-adjusted NPV of above revenue drivers

| Indication | Target population | Annual price | Probability | Peak market share | Year of peak market share | Peak-risk-adjusted revenue |

| AL001, FTD-GRN, U.S. | 5,000, 10% CAGR | $60K, 2% CAGR | 20% | 60% | 2029 | $130.8M |

| AL001, FTD-GRN, E.U. | 10,000, 10% CAGR | $30K, 2% CAGR | 20% | 60% | 2030 | $124.5M |

| AL001, FTD-C9orf72, U.S. | 5,000, 10% CAGR | $60K, 2% CAGR | 20% | 60% | 2030 | $124.5M |

| AL001, FTD-C9orf72, E.U. | 10,000, 10% CAGR | $30K, 2% CAGR | 20% | 60% | 2031 | $60.4M |

| AL002, AD-TREM2, U.S. | 114K, 3% CAGR | $60K, 2% CAGR | 20% | 60% | 2030 | $271.5M (royalties) |

| AL002, AD-TREM2, E.U. | 140K, 3% CAGR | $30K, 2% CAGR | 20% | 60% | 2031 | $79.3M (royalties) |

| AL003, AD-SIGLEC, U.S. | 57K, 3% CAGR | $60K, 2% CAGR | 20% | 60% | 2030 | $135.7M (royalties) |

| AL003, AD-SIGLEC, E.U. | 70K, 3% CAGR | $30K, 2% CAGR | 20% | 60% | 2031 | $79.3M (royalties) |

Calculation of the fair vale of equity

Risk-adjusted NPV of revenue from above indications= $1.6 billion. Risk-adjusted NPV of milestone payment from Abb Vie= $140.6M Value of non-operating assets minus liabilities= $461.17MEstimated fair value of equity= $2.21 billion

Estimated fair value per share using diluted stock count= $32

Initiating coverage on Alector common stock with Buy rating and 1-year price target= $32 (35% upside potential).

Please note that at this early stage of development, the probability has been adjusted to reflect the average for biopharmaceuticals, but as the development stage progresses, the probability increases and therefore the fair value of the stock also increases. As Alector shows success in phase 1, phase 2 etc. of different molecules in the pipeline, its fair value of equity will be adjusted in our model. As such, this fair value of $32/share is by no means the final valuation of the common stock. It just reflects the fair value at present adjusted for the development stage and the opportunity cost in form of the cost of capital. The annual revenue opportunity is approx. $9.3 billion in all above indications (U.S. and E.U.) and as such the shares could trade at a market cap of $65 billion in the future at the peak (at an average price/peak sales ratio of 7 for biotechnology). The current market cap is just $1.3 billion. As such, this investment opportunity could reflect a significant upside potential for patient investors who are willing to hold the shares to realize the full commercial potential of the pipeline. Moreover, if the management succeeds in blue sky scenarios like immune-oncology, ALS or PGRN deficient AD and PD, this could add significant revenue and more upside to the shares.

Risks in the investment:

Investing in developmental stage biotechnology/pharmaceutical companies is risky and may not be suitable for all investors. It is possible to lose the entire capital invested if the product candidates fail in clinical trials. Unexpected side effects may be seen in clinical trials which may cause FDA to place a clinical hold on ongoing trials. Two cases of muscle injury were seen in the AL001 trials which were not considered due to the drug. The company will require a significant amount of additional capital before any of its product candidates reaches the commercial stage. Further equity dilution is likely to put downward pressure on the common stock. Alzheimer's disease is an extremely risky area of drug development with a high failure rate.

Disclosure: I am/we are long ALEC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article represents my own opinion and is not a substitute for professional investment advice. It does not represent a solicitation to buy or sell any security. Investors should do their own research and consult their financial adviser before making any investment. Investing in equities, especially biotech stocks has the risk of significant losses and may not be suitable for all investors. While the sources of information and data in this article have been checked, their accuracy cannot be completely guaranteed.

No comments:

Post a Comment